Why Korean companies have little impact on stock prices even if they announce an earnings surprise

Input

20231017 AM 816

Korean companies’ stock prices were often sluggish even when they announced good performance

httpsimgnewspstaticnetimage366202310170000939776_001_20231017105301358jpgtype=w647

Chosun DB

Again, the market response to the earnings season’s early report card was lukewarm

In other words, only good corporate stocks have risen

LG Electronics is a good example. The stock prices of these stocks rose all at once right after the earnings announcement

Kiwoom Securities advised this week to note that major U.S. growth stocks, including Tesla and Netflix, are scheduled to report earnings

Reporter Jeon Jun-beom bbeom@chosunbizcom

httpsnnewsnavercommnewshotissuearticle3660000939776

——

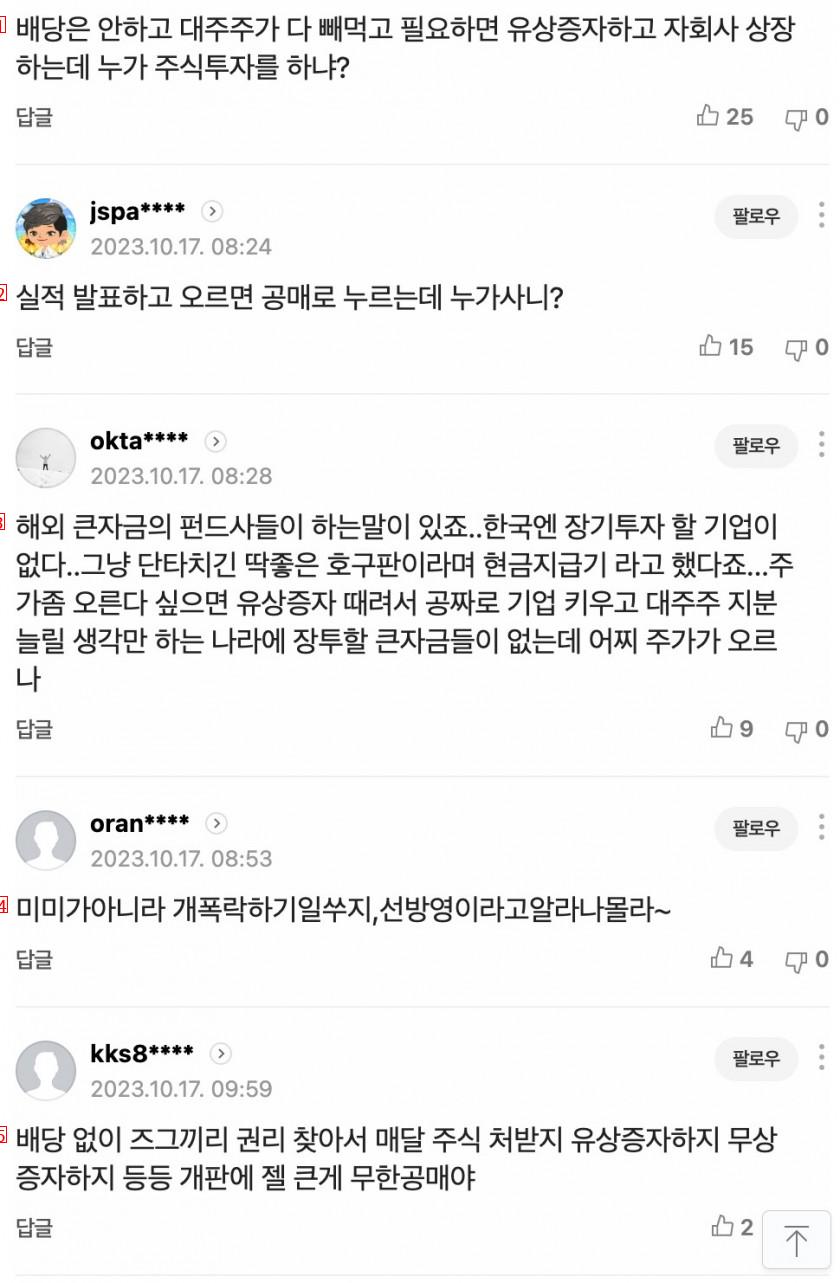

image text translation

(1)Who invests in stocks when major shareholders don’t pay dividends and increase capital if necessary and list subsidiaries

(2)If you go up after announcing the performance, you can’t buy it at public sale

(3)There’s a word from big overseas fund companiesThere are no companies in Korea that can invest in the long termIt’s a good home plate for a single stroke, so I said it’s a cash machineIf the stock price rises a little, how can the stock price rise when there are no big funds to invest in a country that only wants to raise companies for free and increase its stake in major shareholders

(4)It’s not Mimi, but it’s often a pre-broadcast. I don’t know

(5)The biggest thing in the market is unlimited public sale, such as finding rights without dividends, receiving stocks every month, raising capital for free, etc

Why is Korean company’s stock price rise insignificant even if its performance is good -> All the answers come out in the comments