“It’s not only because of the fall in the stock prices of our public offering shares, but also because of soaring stock mortgage loans and negative bank account rates Employees who have invested hundreds of millions of won in debt to our company’s stock,” said an employee of Company A, who went public last year, as they have a monthly interest burden of 2 million won

Executives and employees who purchased our company’s shares with “loans” with their souls are bending their backs against soaring interest rates as well as falling stock prices He fell into the double trap of our private equity, the loss of principal and the burden of interest

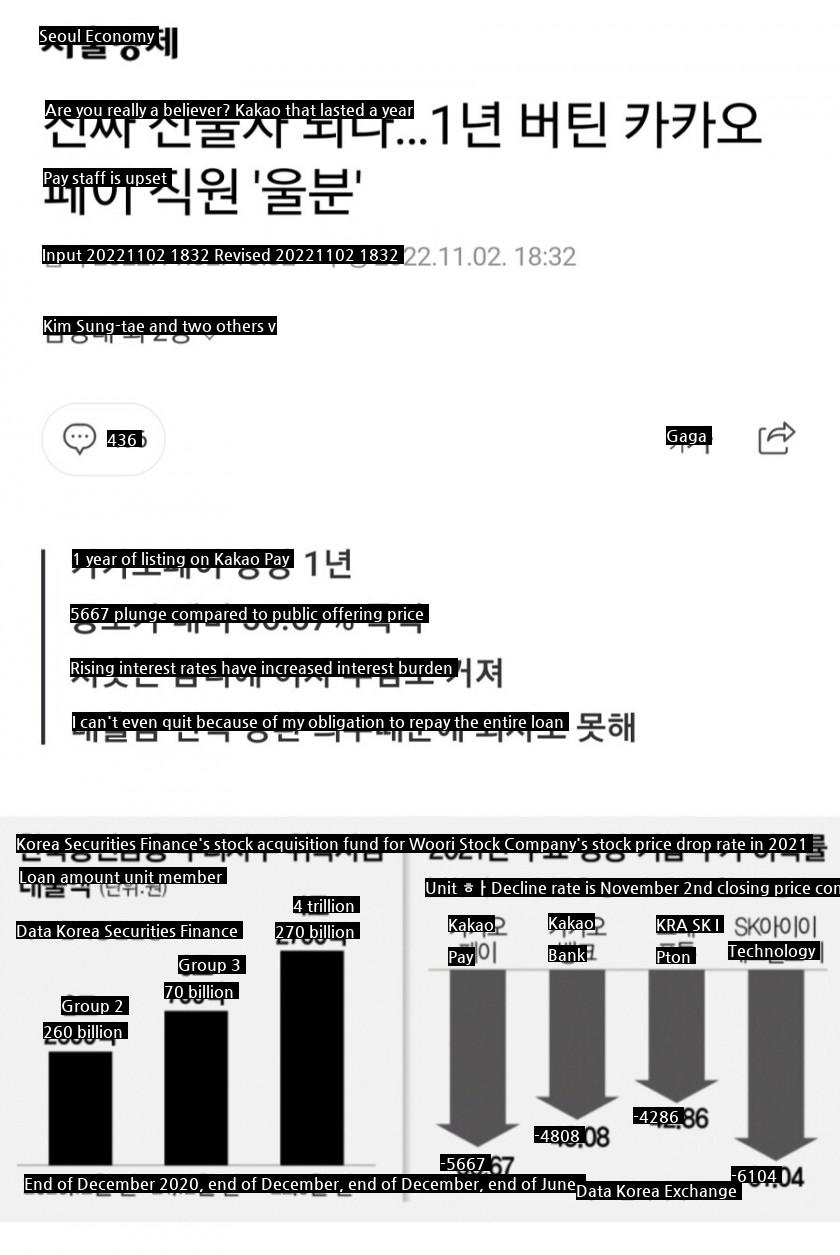

According to the financial investment industry on the 2nd, the mandatory deposit period for Kakao Pay 377300 will expire on the 3rd The stock price plunged 5667 against the public offering price a year after listing and lost principal. At the time of listing, the average amount invested in our stock was 360.42 million won per employee, but the valuation was around 156.18 million won, losing about 200 million won per employee