image text translation

(1)Nexon’s second-largest shareholder, the largest game company, is the government…A short sale will begin soon

image text translation

(1)The Government Becomes Nexon’s Second-Large Shareholder

(2)Short sale process set to begin soon

(3)The Ministry of Strategy and Finance’s Nexon holding company NXC’s second-largest shareholder rises

image text translation

(1)The government, which became Nexon’s second-largest shareholder, will soon launch a public sale

(2)Nexon Holding Company NXC Shareholding Ratio

(3)Data Financial Supervisory Service Electronic Disclosure System Unit

(4)Total number of the same person

(5)Ministry of Strategy and Finance

(6)a moving spouse

image text translation

(1)Summary for Busy People

(2)- Inheritance tax paid after Nexon founder’s death as family stock

(3)- When I paid with family stocks, the government became Nexon’s second-largest shareholder. – It said that the public sale process will begin in the future

image text translation

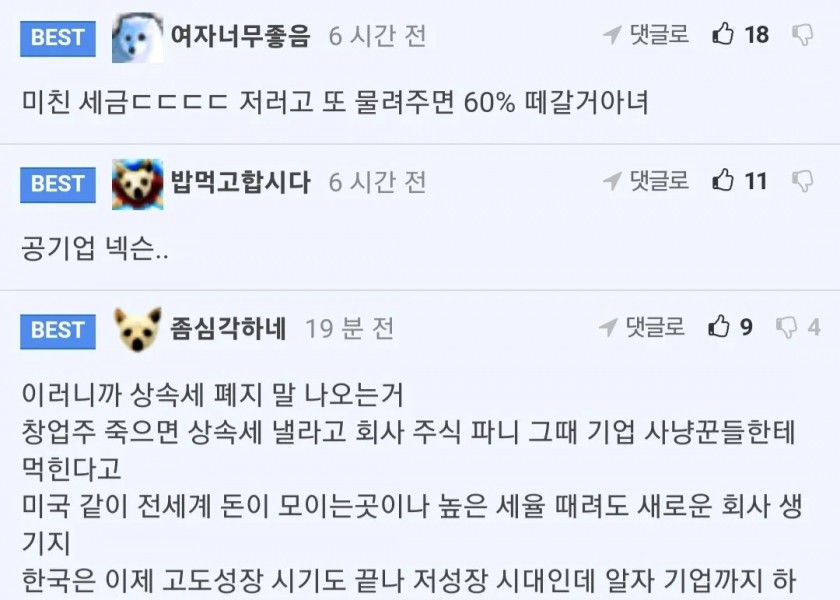

(1)”I like girls so much. 6 hours ago, 18 in the comments.”

(2)Crazy taxes. If you pass them on again, they’re going to take away

(3)1 in the comments. 311

(4)Nexon, a public company

(5)It’s a bit serious. In the comments 19 minutes ago, 394

(6)That’s why people talk about abolishing inheritance tax

(7)If the founder dies, he’s going to pay inheritance tax, and he’s going to be eaten by corporate hunters

(8)A place where money is collected around the world like the United States, or a new company will be created even if the tax rate is high

(9)Korea’s period of high growth is over, and it’s a low-growth era, so if we sell companies one by one

(10)In a country like Korea, if you hit it with a double taxation of inheritance tax and gift tax as in the United States, the existing companies will be known

(11)May be leaked overseas

(12)You can pay gift tax, inheritance tax, and under-listed right now

(13)No businesses can survive double taxation

(14)Samsung Chairman Lee Jae-yong’s refusal to hand over the company to his children also resulted in his inability to pay taxes

!