(1)National tax revenue sources for 2023

image text translation

(2)400 trillion 340 trillion

(3)Ministry of Strategy and Finance

(4)tax revenue error rate

(5)2021! 2022, 2023

(6)Data from the National Assembly Budget Office

(7)Comprehensive real estate tax reduction, all-time

(8)This year’s comprehensive real estate tax plan under the joint name of Eunma 1 house

(9)Gangnam-gu, Seoul

(10)Daechi Eunma Apartment One

(11)Exclusive 84 square meter official price Eunma Town

(12)2,042 million hearts

(13)1.56 billion won

(14)Deduction of up to 1.8 billion won under the joint name of the couple

(15)1.2 billion won for couples, 1.8 billion won for joint name deduction for couples

(16)600 million won per person. 900 million won per person

(17)Comprehensive real estate tax for apartments worth 1.5 billion won

(18)2.26 million won

(19)Applications for special comprehensive real estate tax for 2 weeks from the 16th

(20)Exclusive name deduction limit raised by 1.1 billion → 1.2 billion won

(21)Comprehensive real estate tax revenue is likely to be reduced by KRW 2 trillion from last year

(22)Eunma Apartment in Daechi-dong, a representative reconstruction complex in Gangnam, Seoul

(23)If the couple had a private 84 square meter house under their joint name, last year

(24)I paid more than 2 million won for the entire building, but I won’t pay a penny this year

(25)First of all, the official price, which exceeded 2 billion won last year, fell to 1.5 billion won this year

(26)On the other hand, the basic deduction for comprehensive real estate taxes has increased significantly

(27)In the case of single homeowners, the joint name of the couple has a comprehensive real estate tax of up to 1.8 billion won in the official price

(28)The National Tax Service will hold a joint sale for couples until the 1630th

(29)We’re accepting applications for special applications

(30)This is because deductions, which are larger than last year, are applied only when you apply by yourself

(31)Even if it is not a couple’s joint name, the basic deduction amount increased by 100 million won for a single name

(32)This year, as the tax base for multiple homeowners has been lowered and the official price has fallen

(33)The comprehensive real estate tax is greatly reduced significantly

(1)actual market price transaction

image text translation

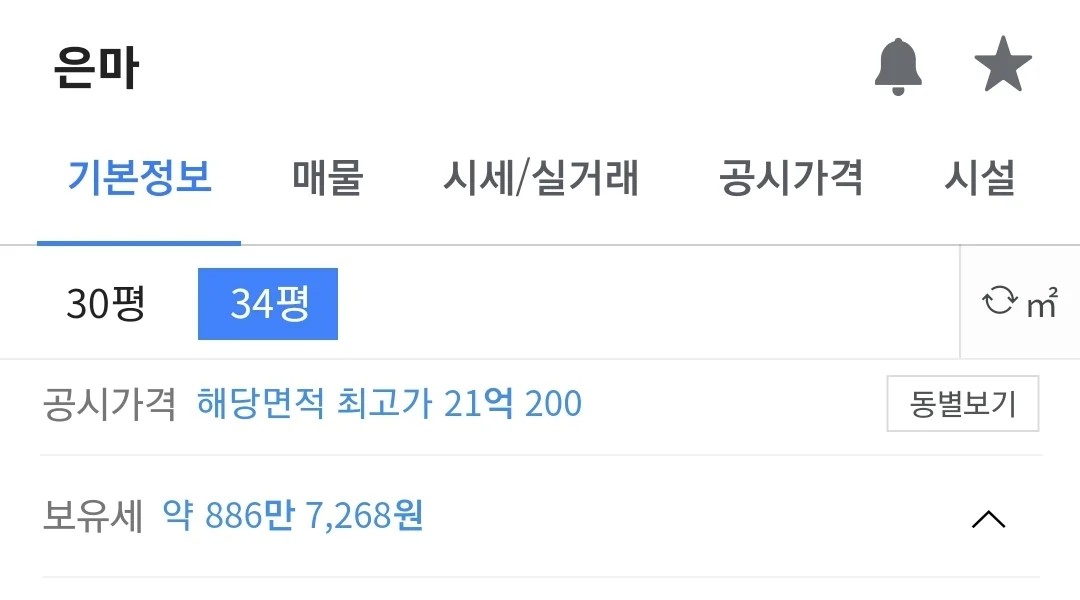

(2)Official price: Area high of 2.1 billion 200 billion

(3)Holding tax is about 8,867,268 won

(4)Property tax of 5,108,580 won

(5)Comprehensive real estate tax of 3,758,688 won

Total holding tax is reduced by 30~40 lol